Inside Gaming: Germany's Online Gaming Strides, Caesars' Loveman Gets Political, & More

Not everyone is out to take your online deposits to pay their executive board. If you're tired of reading about the latest Full Tilt indictment drama, find out how other gaming companies are making bank the legal way. This week, European online gaming sites are excited about the opening of the German market, or at least 1/16th of it. Gary Loveman, Ceasars' CEO, is hoping he has the ear of the future POTUS, and now that the Sahara's owners also own their own debt, they can be creative about how to resurrect the old-Vegas landmark.

German State Votes to License and Tax Online Sports Betting and Poker

Schleswig-Holstein became the first of Germany's 16 states to relax its anti-online gaming stance when the state parliament voted 46-to-45 last week to allow sports betting and poker sites to operate in the state as long as they are established in the European Union. Germany has been debating what to do about online gaming since the European Union's high court ruled the country's national monopoly on gambling violated the Union's free trade laws.

Site owners must apply for an unlimited number of licenses and pay 20 percent of their earnings in taxes to the state. The Schleswig-Holstein law is far more favorable to gaming sites than those proposed by the other states. Some of the draft laws limit licenses to seven per location, and most call for a 17 percent tax on every bet placed rather than on gross profit.

Dirk Hundertmark, spokesman for the Christian Democrats in the Schleswig-Holstein Parliament, said he expected Schleswig-Holstein to collect between 40 and 60 million euros a year in taxes, mostly from sports book websites. Germany's sports betting market, most of which is illegal, is worth upwards of 5 billion euros ($7.2 billion.)

British online gambling operator Bwin.party Digital Entertainment Plc saw its shares jump nine percent following news of the vote. Betfair Group Plc's stock moved up two percent. Both companies previously announced plans to apply for licenses in Schleswig-Holstein if the law passed. "We are now hopeful that the other 15 German states will make the regulated amendments to their proposed State Treaty, in order to bring it into line with EU law," Betfair said.

Read more from Bloomberg and Reuters.

Caesars' Loveman Named Huntsman Campaign Advisor

Caesar Entertainment Chairman Gary Loveman was named to Republican presidential candidate Jon Huntsman's business advisory council. Loveman, along with three other prominent executives, will help Huntsman craft policies on economic issues.

Loveman's appointment comes a week after he appeared on the "Nightly Business Report" on PBS to critique the speech President Barack Obama gave to discuss the administration's job creation efforts. On the show, Loveman said that Obama should have addressed the housing crisis as part of the speech. "If we don't stimulate the housing market properly, there's very little likelihood we'll see meaningful job growth," Loveman said. Although Loveman lives on the east coast, he spends plenty of time worrying about Las Vegas, one of the hardest hit housing markets in the country.

Huntsman, a former governor of Utah and U.S. ambassador to China, was the first Republican presidential candidate to present an economic plan, which earned the glowing Wall Street Journal endorsement, "better than anything so far from the GOP Presidential field." In addition to Loveman, Huntsman's business advisory council will include Nike Chairman Phil Knight and Tom Bell, former chairman of the U.S. Chamber of Commerce. Huntsman chose John Mack, an executive chairman at Morgan Stanley, to head the council.

Loveman is not the only casino-industry exec to voice his GOP leanings. Steve Wynn has spoken out about his passionate dislike of the current administration, and Sheldon Adelson, chairman and CEO of Las Vegas Sands Corp., is a major Republican donor and fundraiser.

Get more campaign details in The Las Vegas Review-Journal.

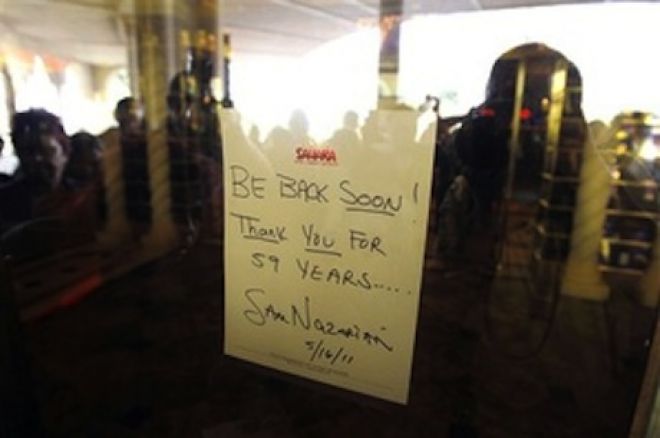

Sahara Owners Purchase Mortgage, Move Toward Redevelopment

The owners of the closed Sahara Hotel and Casino purchased the mortgage to the property last week in a move that gives the company more freedom to reinvent and eventually reopen the casino. Owners SBE Entertainment, known for its nightclub projects, and Stockbridge Real Estate Funds bought the debt from the primary lender, Royal Bank of Scotland Group Plc., for an undisclosed amount, likely at a steep discount. The mortgage was originally for $288 million when SBE and Stockbridge took it out to finance their acquisition of the Sahara for a total of $350 million.

"We've invested substantial new equity to acquire the note, allowing us complete flexibility to re-envision this property," said Sam Nazarian, CEO of SBE. His statement also said that SBE hired Gensler Architects, one of the firms that designed CityCenter, and PENTA Building Group "to evaluate a range of options for the property." Range of options is about as specific as the statement got. There were no hints about a timetable for reopening the Sahara or if SBE plana to remodel or implode the existing structure. Nazarian did make sure that the media was alerted to the forward step, however, a good sign that a plan is in the works.

The Sahara, the last remaining landmark from Rat Pack-era Las Vegas, closed in May after suffering through several years of recession and the decline of the north end of the strip.

VegasInc.com has more.

Follow PokerNews on Twitter for up-to-the-minute news.

*Photo courtesy of TimesLeader.com